Zenith , Larger Banks More Resilient Fitch Declares In Stress Test

The stress test conducted by the Central Bank of Nigeria (CBN) has

confirmed the resilience of large banks to withstand stresses over smaller

banks, even as it singled out Zenith Bank Plc for its strength in comparison to

others

Citing a Financial Stability Report for December 2016, published

recently, rating agency, Fitch, said

in its review of the regulatory test

highlighted disparities in capital strength in the Nigerian banking industry.

The apex bank’s test showed that 3 big banks failed, with their capital

adequacy ratio haven significantly fallen below the regulatory requirement.

The rating agency said in its analysis of the CBN report: “… medium and

large banks collectively could withstand a 100% increase in non-performing

loans (NPLs) but small banks (assets less than NGN500 billion) would struggle

to withstand even modest NPL deterioration.

“In our own assessment of the banks we rate, which are mostly large

(assets more than NGN1 trillion), capacity to absorb losses through capital

varies considerably.

“Zenith Bank Plc is stronger than the rest, while capital weaknesses at

First Bank National and Diamond Bank have a significant influence on their

ratings,” it added.

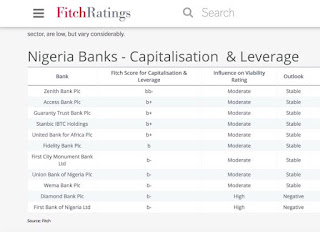

“All Nigerian bank ratings are in the highly speculative 'B' range, but

even so capitalisation is an important differentiator. The scores we assign,

based on capitalisation and leverage metrics across the sector, are low, but

vary considerably,” the agency explained.

The apex bank’s stress test focused on the ability of banks' capital

adequacy ratios to withstand a number of impairments arising from

Non-Performing Loans and Fitch noted in its analysis that small banks were

particularly badly hit in the stress tests.

“They already had very weak starting capital positions, with an average

capital adequacy ratio (CAR) of just 3.14% at end-2016, following sharp falls

in 2016 due to rises in NPLs. Medium and large banks had stronger starting

positions, with CARs of 12.75% and 15.47%, respectively, at end-2016,” the

agency stated.

The agency also stated: “CBN figures show that NPLs represented 14% of

total sector loans at end-2016, a very sharp increase on 5.3% at end-2015.

Unreserved NPLs represented a high 38.4% of total end-2016 regulatory capital

(end-2015: 5.9%), signaling considerable weakening in the overall capital

position of Nigeria's banking sector.

“Reported NPL ratios do not tell the whole asset quality story.

Restructuring, particularly of loans extended to the troubled upstream oil

sector, is fairly common practice in Nigeria, and restructured loans at some

rated banks account for as much as 20% of total loans,” it added.

It further noted that there was good ground to belief that that capital

buffers at banks may be weaker than reported ratios suggest.

The banks, the agency noted, remain profitable, with results boosted by

wide margins and currency revaluation gains, large in some cases.

“These are one-off gains but they have been realised and provide a

strong boost to capital, which is positive, especially in light of weak asset

quality,” it said.

The CAR is the ratio of bank’s assets to its risks. It is placed at 10

per cent for national banks and 15 per cent for banks with international

subsidiaries and 16 per cent for Systematically Important Banks (SIBs).

Comments

Post a Comment